Defiance Silver Corp. (“Defiance” or the “Company”) is pleased to provide the final results from seven drill holes drilled during the 2022 drill program. These holes were designed to improve the main Veta Grande structural model and to test splays to the Veta Grande system, including the footwall San Herculano structure.

Highlight of Results

- DDSA-22-62 – Encountered a base metal rich portion of the Veta Grande structure, returning 2.58m of 423 g/t AgEq (from 213.40m to 215.98m) within a wider 11.22m intercept of 152 g/t AgEq (from 205.15m to 216.37m).

- DDSA-22-61 – Returned 1.49m of 399 AgEq (from 231.28m to 232.77m) within a wider interval of 4.97m of 142 g/t AgEq (from 230.04m to 235.01m). This hole tested up dip of historical holes SAD-15-09 and SAD-15-10, and below hole DDSA-22-59 (2.42m of 123 g/t AgEq, reported in this release). Historic workings were encountered higher in the hole, while drilled mineralization occurred between the main VG structure and a hanging wall splay.

- DDSA-22-60 – Returned 6.98m of 114 g/t AgEq (from 31.10m to 38.08m) on the Veta Grande and encountered historic workings from a downhole depth of 33.25m to 34.75m.

- DDSA-22-59 – From surface returned 9.57m of 175 AgEq (from 1.38m to 10.95m). This hole drilled reportable grade in three locations: surface waste dumps, the main Veta Grande structure, and possible San Herculano structure. In-situ vein material from Veta Grande grades 2.42m of 123 g/t AgEq (from 27.30m to 29.72m).

Chris Wright, Chairman & CEO, commented: “This phase of drilling was designed to strengthen our understanding of the historical underground development of the Veta Grande vein system, which is critical for both the geologic modelling and the updated resource estimation that we are working towards. We are encouraged by the wide widths of near surface mineralization alongside high grades of Pb-Zn mineralization encountered in this phase of drilling.”

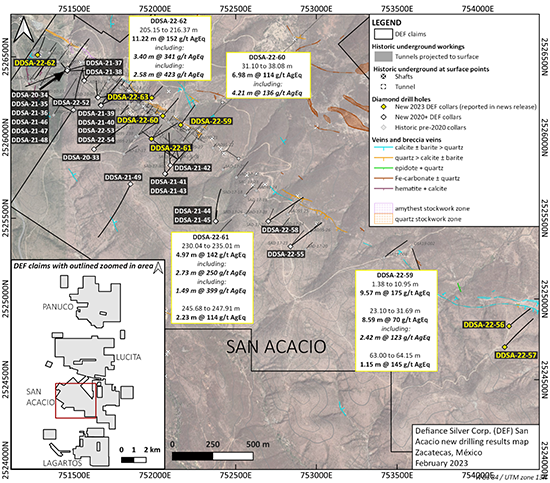

Overview Map of Drill Locations

Figure 1 – Plan map of Defiance’s San Acacio project area, including location of current and past drill holes.

Discussion of Results

Defiance undertook a drill program in late 2022 to gather additional data in the San Acacio resource area. These holes were designed to improve the main Veta Grande structural model and to infill poorly-drilled areas, as well as to test both hanging wall and footwall splays to the Veta Grande system. The footwall San Herculano structure was one of the main exploration targets of this phase of drilling.

Drill hole DDSA-22-59 was targeted to hit the Veta Grande vein system near surface and test the deeper San Herculano vein target. The hole was collared into surface waste material from historic mining and returned 9.57m grading 175 g/t AgEq from 1.38m down hole. The overall grade and tonnage of waste material is unknown. The Veta Grande structure was intersected near surface (2.42m grading 117 g/t AgEq from 27.30m). An additional mineralized structure was encountered in the footwall of the Veta Grade; it is not yet clear whether this represents San Herculano or another structure.

Drill hole DDSA-22-60 was a 130 metre step out to the northwest from hole DDSA-22-59. The hole was also designed to hit the Veta Grande near surface and to test the San Herculano vein at depth. The Veta Grande structure was again intersected near surface and contained 6.98m grading 114 g/t AgEq from 31.10m down hole. Most grade appears to be contained in remaining vein material that was not historically mined; 1.5 metre wide workings were encountered from 33.25 to 34.75m. Anomalous structures were encountered in the San Herculano zone.

Drill hole DDSA-22-61 was designed to test hanging wall vein splays and the main Veta Grande vein. This hole tested up dip of historical holes SAD-15-09 and SAD-15-10, and below hole DDSA-22-59. Historic workings were encountered at the modelled location of the main hanging wall splay; in-situ mineralization was hit between the main VG structure and the hanging wall splay. Hanging wall splay mineralization returned 2.37m grading 250 g/t AgEq from 230.04m, while the main Veta Grande zone returned 2.23m of 114 g/t AgEq from 245.68m.

Drill hole DDSA-22-62 was drilled in the far NW part of the property, under Tajo Carolina, a historic surface mining area. This hole successfully intercepted both the modelled Veta Grande hanging wall splays and the main mineralized Veta Grande structure. Again, the intercepted mineralization is within and between Veta Grande and a hanging wall vein splay. The hole encountered a base metal rich portion of the Veta Grande structure, returning 2.58m of 423 g/t AgEq (from 213.40m to 215.98m) within a wider 11.22m intercept of 152 AgEq (from 205.15m to 216.37m).

Drill hole DDSA-22-63 was designed to test the Veta Grande footwall splay, including the San Herculano structure and did not drill the Veta Grande structure itself. Several zones of alteration and anomalous metal values were encountered in the foot wall to the Veta Grande structure in this area. Whilst none of the intercepts are reported here, the style and metal assemblage of the anomalous zones is encouraging.

Drill holes DDSA-22-56 and 57 were designed to test a calcite rich outcrop 2 km to the south-east of the resource area but along the regional Veta Grande structure. Hole DDSA-22-56 intercepted hydrothermal material and alteration at the projection of the Veta Grande structure. Trace elements present in the intercepted zone suggest that the structure was hit in the upper levels of the epithermal system. Hole DDSA-22-57 deviated significantly to the east and drilled outside the target zone.

San Herculano Vein Target

The San Herculano structure is located in the footwall of the Veta Grande vein. San Herculano is a recently-identified target revealed during surface mapping and reviews of historical documents about the underground workings. It is currently unknown if the historical miners were successful in removing economic material from this area; however, the appreciable amount of development effort is encouraging from an exploration perspective.

Drill holes targeting the San Herculano structure intersected thin zones of anomalous silver and base metal mineralization. Whilst a formal San Herculano vein has yet to be identified, the company believes that exploration in semi-parallel structures to the Veta Grande warrants follow up exploration.

Table of Results

| Hole | From | To | Interval (m) | Ag g/t | Au g/t | Pb % | Zn % | AgEq g/t |

| DDSA-22-59 | 1.38 | 10.95 | 9.57 | 157.38 | 0.12 | 0.06 | 0.10 | 175 |

| DDSA-22-59 | 23.10 | 31.69 | 8.59 | 59.60 | 0.07 | 0.03 | 0.07 | 70 |

| Including | 27.30 | 29.72 | 2.42 | 117.89 | 0.04 | 0.01 | 0.02 | 123 |

| DDSA-22-59 | 63.00 | 64.15 | 1.15 | 45.42 | 0.34 | 1.32 | 0.64 | 145 |

| DDSA-22-60 | 31.10 | 38.08 | 6.98 | 81.09 | 0.17 | 0.01 | 0.07 | 114 |

| Including | 31.10 | 35.31 | 4.21 | 119.21 | 0.12 | 0.01 | 0.04 | 136 |

| DDSA-22-61 | 230.04 | 235.01 | 4.97 | 133.58 | 0.02 | 0.01 | 0.04 | 142 |

| Including | 230.04 | 232.77 | 2.73 | 236.67 | 0.04 | 0.00 | 0.06 | 250 |

| Including | 231.28 | 232.77 | 1.49 | 377.79 | 0.06 | 0.00 | 0.10 | 399 |

| DDSA-22-61 | 245.68 | 247.91 | 2.23 | 94.56 | 0.14 | 0.01 | 0.03 | 114 |

| DDSA-22-62 | 205.15 | 216.37 | 11.22 | 23.98 | 0.34 | 0.69 | 1.69 | 152 |

| Including | 212.97 | 216.37 | 3.40 | 50.45 | 0.71 | 1.72 | 3.85 | 341 |

| Including | 213.40 | 215.98 | 2.58 | 58.02 | 0.85 | 2.25 | 4.88 | 423 |

Table 1 – Silver equivalent is calculated using the following formula: Silver-Equivalent (AgEq) = [(Au_ppm x 60.34)+(Ag_ppm x 0.70)+(Pb_ppm x .0021)+(Zn_ppm x 0.0032)]/ 0.70. Metal price assumptions are Au:$1877, Ag:$22, Pb: $0.97, Zn:$1.48. A 30 day metal price average is used to determine metal prices and 100% recovery has been assumed for all metals. At this stage of the project, reliable metallurgy has yet to be completed, and the reader is cautioned that 100% recoveries are never achieved. True thickness is assumed to be 50%-80% of downhole width.

Drill Hole Information

| Hole Number | Total Depth | Azimuth | Dip | Easting | Northing | Elevation (m) |

| DDSA-22-56 | 249.0 | 48 | -49 | 754195 | 2524825 | 2478 |

| DDSA-22-57 | 379.2 | 42 | -51 | 754168 | 2524705 | 2488 |

| DDSA-22-59 | 240.6 | 39 | -50 | 752160 | 2526077 | 2590 |

| DDSA-22-60 | 261.7 | 40 | -55 | 752049 | 2526139 | 2599 |

| DDSA-22-61 | 338.1 | 60 | -55 | 751977 | 2525989 | 2642 |

| DDSA-22-62 | 276.5 | 25 | -63 | 751269 | 2526510 | 2585 |

| DDSA-22-63 | 206.7 | 43 | -62 | 751984 | 2526248 | 2578 |

Table 2 – Drill collar details. All coordinates in WGS84 UTM Zone 13N.

Next Steps

Planned 2023 drilling at the Zacatecas project includes programs for resource expansion, (including metallurgical testing), brownfields exploration, and greenfields exploration, incuding:

- Resource expansion drilling that will be focused in the current resource area, designed to delineate additional tonnage of mineralisation outside of the current resource estimate.

- Brownfields exploration designed to test newly recognized hanging wall and footwall vein splays, offset structures at depth, and additional targets in close proximity to the historical workings.

- Greenfields exploration that will be a combination of follow up drilling on the recent first-pass success at Palenque and first-pass drilling on regional targets including the northern Zacatecas district at Pánuco.

Discussion of QAQC and Analytical Procedure

Samples were selected based on the lithology, alteration, and mineralization characteristics; sample size ranges from 0.25 – 2m in width. All altered and mineralized intervals were sent for assay. One blank, one standard, and one duplicate were included within every 20 samples. Standard materials are certified reference materials [CRMs] from OREAS and contain a range of Ag, Au, Cu, Pb, and Zn values. Blanks, standards, and duplicates did not detect any issues with the analytical results.

Samples were analyzed by ALS Chemex Laboratories. Sample preparation was performed at the Zacatecas, Mexico, prep facility, and analyses were performed at the Vancouver, Canada, analytical facility. All elements except Au and Hg were analyzed by a multi-element geochemistry method utilizing a four-acid digestion followed by ICP-MS detection [ME-MS61m]; mercury was analyzed after a separate aqua regia digest by ICP-MS. Overlimit assays for Ag, Pb, and Zn were conducted using the OG62 method (multi-acid digest with ICP-AES/AAS finish). Gold was measured by fire-assay with an ICP-AES finish [50g sample, Au-ICP22].

San Acacio History

Zacatecas State continues to be the top producer of silver in Mexico and is one of the reasons Mexico remains the world’s largest silver-producing region. The Zacatecas-Fresnillo Silver Belt is one of the most prolific silver producing areas in the world. Production at the San Acacio mine dates to at least 1548 when Spanish colonialists mined mainly bonanza oxide ores, typically grading in excess of 1kg/tonne silver. The various veins were mined intermittently until the mid-1800s when an English company drove the ~2km Purisima tunnel to allow for deeper underground access and drainage. From the late 1800s until the Mexican Revolution in 1920, mining consisted of intermittent production from bonanza grade ores. During the Mexican Revolution, heavy fighting in the Zacatecas region led to the halt of most mining endeavors. In the mid 1920’s, a cyanide plant targeting silica rich ores and a floatation plant for complex Pb-Zn ores were built with varying success until the transition from oxide to sulphide rich ores made for recovery complexities. In the mid 1930s the first tonnage estimate was created on the property, although the project sat mostly idle save for some stope and adit rehabilitation at Purisima and Refugio. Production was largely dormant except for some small processing done by CIA Fresnillo in the late 1930s to early 1940s. In the mid- 1990s Silver Standard Resources Inc. began a systematic exploration and evaluation program targeting an open pit silver mine consisting of backfill, remaining stopes and silica-rich hanging wall and footwall mineralization of the Veta Grande structure. This entry by a publicly-listed company kicked off nearly 3 decades of exploration, development, and bulk-scale processing.

Defiance Silver has been exploring the project since 2011 and has focused primarily on identifying mineral resources. Drilling by previous operators as well as Defiance Silver from 2009 to early 2017 confirmed the presence of significant mineralizing events that provide evidence for a long-lived mineralizing system. Drilling in late 2017 and early 2019 outlined complexities in the structural geology of the area and identified significant “down dropped” and rotated structural blocks as the company tested the Veta Grande at similar elevations where it was encountered by earlier mining and drilling.

San Acacio hosts a current inferred mineral resource estimate containing 16.97 Moz silver (17.76 Moz AgEq) grading 181.94 g/t silver (192.5 g/t AgEq) with a 100 g/t AgEq cut off (see the Technical report titled: Technical Report and Resource Estimate, San Acacio Silver Deposit, Zacatecas State, Mexico by Giroux and Cuttle dated September 26, 2014, which is available on Sedar and the company’s website here).

Other Corporate Matters

Defiance announces that the company is making a management change. Sherry Roberge, the company’s Chief Financial Officer and Corporate Secretary, will be leaving the Company on April 5, 2023 and the company has commenced an executive search for a new Chief Financial Officer and Corporate Secretary.

The company also announces that it has previously engaged Soar Financial Partners, a brand of NorthStar Communications GmbH (“Soar”) and Tarik Dede (“Dede”), to perform services for the Company, including investor relations activities, as defined in accordance with the policies of the TSX Venture Exchange (“TSXV”) and applicable securities laws.

Pursuant to an agreement entered into with Soar on May 15, 2021 for a period of one year, Soar will receive a cash fee of €4,750 per month, due quarterly upfront. In addition, fees for any blogging services provided by Soar will result in an additional fee of €1,750 per month, due quarterly upfront, and road show fees of €2,850 per road show day. At the discretion of the board of directors of the Company, Soar may also receive stock options, pursuant to TSXV policies. In case no options are granted the Retainer fee is increased by 25%. The Company retained Dede for blogging services on a per transaction basis. Dede will receive a cash fee of €750 per month and will not be issued any stock options for its services. Both parties are arm’s length parties and still currently engaged. Defiance also announces an update to the Shares for Debt transaction (See News Release dated December 6th, 2022), regarding consulting services rendered for the company by an arm’s length party, Rhea Advisors, LLC (“Rhea”). The scope of these services were related to in-house marketing, communications, and project-based consulting with management.

About Defiance Silver Corp.

Defiance Silver Corp. (DEF | TSX Venture Exchange; DNCVF | OTCQX; D4E | Frankfurt) is an exploration company advancing the district-scale San Acacio Deposit, located in the historic Zacatecas Silver District and the Tepal Gold/Copper Project in Michoacán state, Mexico. Defiance is managed by a team of proven mine developers with a track record of exploring, advancing and developing several operating mines and advanced resource projects Defiance’s corporate mandate is to expand the San Acacio and Tepal projects to become premier Mexican silver and gold deposits.

Mr. George Cavey, P.Geo, V.P Exploration for Defiance Silver is a Qualified Person within the meaning of National Instrument 43-101 and has approved the technical information concerning the Company’s material mineral properties contained in this press release.

On behalf of Defiance Silver Corp.

“Chris Wright”

Chairman of the Board

For more information, please contact: Investor Relations at +1 (604) 343-4677 or via email at info@defiancesilver.com.

Suite 2900-550 Burrard Street

Vancouver, BC V6C 0A3

Canada

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. Defiance Silver Corp. relies upon litigation protection for forward-looking statements.